Financial Strength Purpose. Passion. Progress.

At WoodmenLife, we understand what is truly important – keeping your interests in mind as we make decisions that impact the future and overall financial strength of our company.

At WoodmenLife, we understand what is truly important – keeping your interests in mind as we make decisions that impact the future and overall financial strength of our company.

In 2024, WoodmenLife demonstrated outstanding financial performance, with a total income of nearly $1.1 billion and certificate reserves (funds held to guarantee future benefit payments) of almost $8 billion.

WoodmenLife finished Fiscal Year 2024 with positive results, including assets of $11.3 billion1 and $39.4 billion of insurance in force.

In addition, total surplus for WoodmenLife increased to nearly $1.8 billion in 2024.

$11.3 billion in assets for 2024

DOLLARS IN ASSETS (BILLIONS)

LIABILITIES $9.6 BILLION; AS OF DEC. 31, 2023

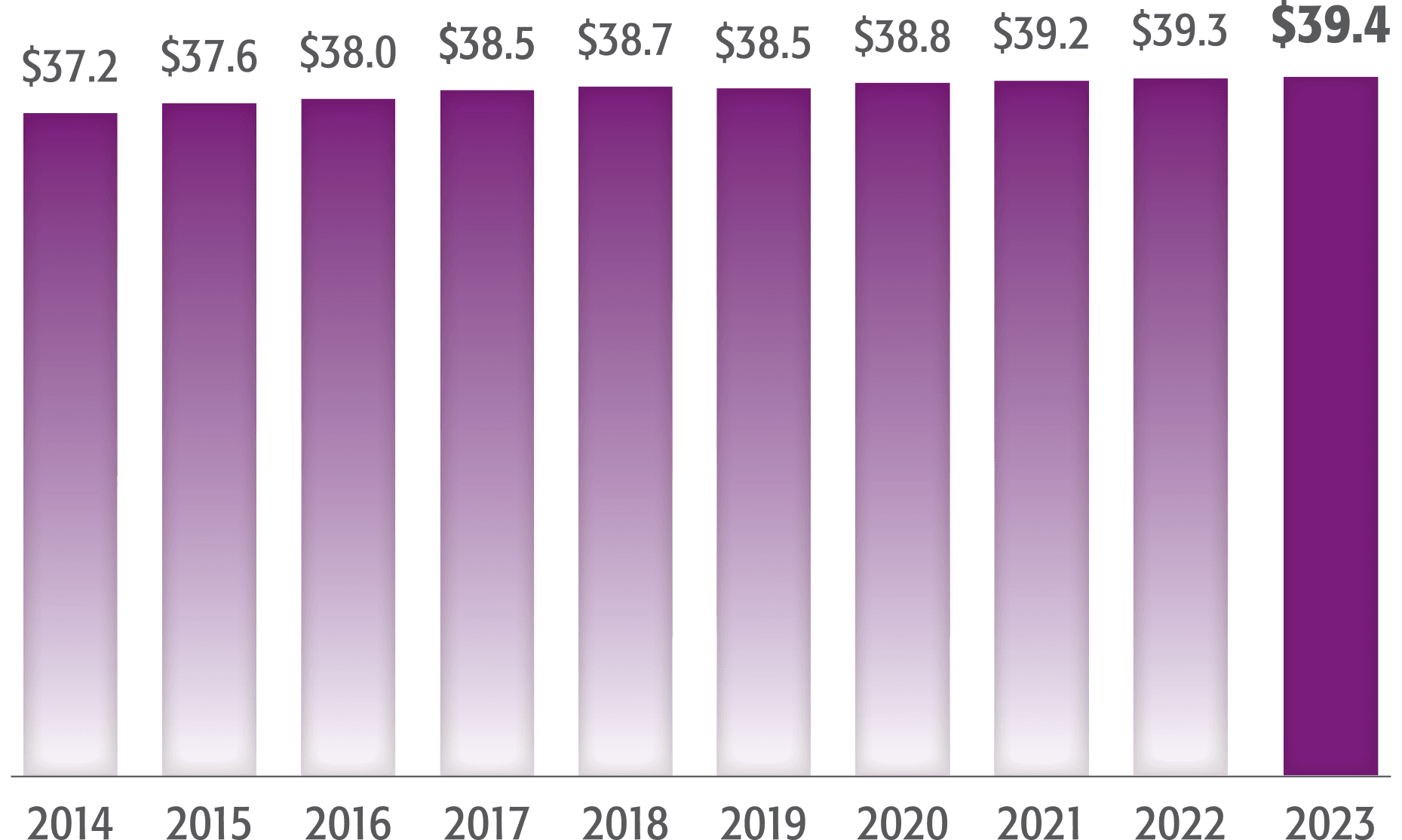

$39.4 billion of insurance in force for 2024

DOLLARS OF FACE AMOUNT IN FORCE (BILLIONS)

$1.8 billion in surplus in 2024

(BILLIONS)

One way to judge the strength of a company is to look at how its financial strength and performance are rated by an objective rating agency. Our rating is a direct reflection of the care with which WoodmenLife manages our business.

WoodmenLife was assigned a rating of A+ Superior2, the second highest out of 13, again in 2024. It was the 49th consecutive year we received the A+ Superior rating.

Chair, President & CEO

WoodmenLife

Omaha, NE

In an industry based on long-term success, you want to trust your time and money with a company you know will perform. An organization’s investment philosophy directly affects its security and is a vital factor in its growth and stability. We don’t chase profits to please stockholders; we pursue the best interests of our members. WoodmenLife is an organization that has lasted more than a century by looking ahead and doing what’s right.

Another sign of WoodmenLife’s strength is that our investment income has remained steady.

Bonds commonly referred to as “investment grade” are those included in the top four rating categories – Aaa, Aa, A and Baa. Bond ratings are like grades on a report card, with Aaa carrying the smallest degree of investment risk, and C being the highest. At year-end 2024, 99% of WoodmenLife’s bond holdings were investment grade.

Real estate accounted for just under 1% of WoodmenLife’s invested assets in 2024. These holdings consist of property that is owned by, and either leased to others or occupied by, WoodmenLife.

At the end of 2024, 21.3% of our assets were in mortgage loans. These loans are secured by commercial real estate, including office, retail, and industrial properties. WoodmenLife is always a first-lien mortgage holder, and we finance no more than 75% of a property’s value.

Refunds3 paid to members holding life and accident and health certificates during 2024 were $19 million.

Total assets of $11.3 billion. Liabilities of $9.5 billion; as of Dec. 31, 2024.

Effective Feb. 7, 2025, WoodmenLife is rated A+ Superior by AM Best for our financial strength and operating performance. For the latest Best’s Credit Rating, access www.ambest.com

Refunds are declared annually by the company. The payment of refunds is not guaranteed because they depend on the company’s investment, expense and mortality experience.

Web 3 R-4/25