Indexed Universal Life Insurance Smart and Easy Financial Choices

Indexed Universal Life (IUL) insurance protects your loved ones while providing the opportunity to build cash value.

Indexed Universal Life (IUL) insurance protects your loved ones while providing the opportunity to build cash value.

As you plan for the future, a wide range of options are available. IRAs, 401(k)s, savings accounts, mutual funds, CDs … the list goes on, and the options can be confusing. If taking care of your loved ones and building your best financial future top your list, our indexed universal life insurance (IUL) can help you work toward both these goals. Indexed universal life insurance protects your loved ones while providing the opportunity to build cash value.

My Choice IUL offers two ways to grow cash value: a fixed account, which earns a competitive, current interest rate; and an indexed account that earns interest linked to the performance of the S&P 500® Index1.

This indexed universal life insurance also provides flexibility in timing and amount of payments2. That means if you get a raise, receive a tax refund or reach a point in your life where you have more available income, you can add more funds to your account3.

The WoodmenLife My Choice IUL meets you where you are in your life. Whether you’re just beginning to plan for the future, close to retirement or past your working years, we’ve designed this product to help you meet your goals4. In addition to offering life insurance protection for you and your family, our Indexed Universal Life insurance can accumulate cash value over time, so funds may be available to cover a financial emergency or supplement your retirement income5.

My Choice IUL can pay a death benefit to the people and/or organizations you love. You can choose a face amount starting at $25,000. When you’re gone, your beneficiaries will receive the death benefit.

The money you leave behind can help make a big difference in the lives of those that mean the most to you. This could be your spouse continuing to afford the life you live now, your children being able to take care of your funeral costs and debts or your church making improvements to their building.

The premium amount goes toward the cost of your life insurance plus any expenses related to your policy. The rest will be set aside for potential growth. If you wish, you may customize this premium so you are contributing even more each month to your cash value.

Income Tax-free Death Benefit

You can take comfort in knowing you are providing a planned gift. Your beneficiaries will not have to pay income taxes on the money they receive6.

Build Your Assets

My Choice IUL gives you the freedom to build assets through cash value accumulation. It provides the potential for growth linked to an index while still having an income tax-free death benefit.

My Choice IUL offers the potential to accumulate cash value that you can access when you need it most. The growth to your cash value, especially if you make contributions above your minimum required premium, could become a source of tax-deferred money in your retirement years. Your cash value is available through a partial surrender or loan5.

If you need to withdraw money from your My Choice IUL, you can request a partial surrender of your policy's cash value. This amount is income tax-free up to the amount you have paid into your policy8. However, the available amount may be impacted by cost of insurance and any riders. You never have to repay the withdrawn amount, but it will reduce the cash value and death benefit of your policy.

Another way to access cash from your My Choice IUL is by taking out a loan against your cash value. The loaned amount may be tax-free, but it will be charged interest. You can choose to pay back the loan, or the loan amount will be paid through a decrease in your death benefit.

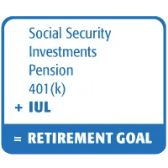

Supplemental Retirement Income Stream

As you near retirement, you may access the cash value in your My Choice IUL to supplement your other sources of retirement income4,5.

Handle Emergencies

You can take comfort in knowing that the cash value in your My Choice IUL will be available when unexpected expenses come up5.

Help During Illness

When the unexpected happens, My Choice IUL offers protection with Chronic and Terminal Illness Accelerated Death Benefit Riders9. These riders allow you to access a portion of your life insurance benefits while you are still living — at no additional cost.9

How much do you want to leave behind and how much extra would you like to build for retirement? Whether you’re just starting out or have already considered your needs, your Representative can help you determine how to get there.

You’ll work with your Representative to determine payments that fit within your current budget, while still helping you accomplish your long-term goals. Don’t forget, you can always increase your payments down the road.

You can personalize your indexed universal life insurance coverage with a variety of riders at added cost.

Make smart choices for your future. We can help you find the best way to reach your goals.

IUL is not an investment. It is a life insurance certificate product that provides growth potential through index interest crediting. You cannot invest directly in an index.

Paying less may reduce your cash value and affect the period your certificate stays in force.

Subject to IRS limitations.

The IUL product is not intended to serve as a primary source for retirement, pension income, or deferral of taxable income.

Loans and withdrawals will reduce the certificate's death benefit and available cash value. Loans against the cash value will accrue interest. Excessive loans or withdrawals may cause the certificate to lapse. A loan, withdrawal, or surrender may be a taxable event. For advice, consult with your professional tax advisor.

Certain charges will not reduce when decreasing the face amount of insurance or after taking withdrawals from the certificate.

Death benefit proceeds from a life insurance certificate are generally not included in the gross income of the taxpayer/beneficiary (Internal Revenue Code Section 101(a)(1)). There are certain exceptions to this general rule including policies that were transferred for valuable consideration (IRC §101(a)(2)). This information should not be construed as tax or legal advice. Consult with your tax or legal professional for details and guidelines specific to your situation.

Guarantees are backed by the claims-paying ability of WoodmenLife.

There may be tax implications for policies recognized as modified endowment contracts (MECs). Distributions, including loans, from a MEC are taxable to the extent of the gain in a certificate, and may also be subject to a 10% additional tax if the owner is under age 59½. Excessive loans or withdrawals may cause the certificate to lapse. Loans and withdrawals will reduce the certificate's death benefit and available cash value. A loan, withdrawal, or surrender may be a taxable event. For tax advice, consult with your professional tax advisor.

Forms ICC10 257 6-10, 257 6-10 (XX), O-257 6-10 (XX), and 257-XX-0409. All contractual provisions apply and may vary by state. Benefit payments may affect eligibility for public assistance programs. Maximum benefit is the lesser of $250,000 or 65% of death benefit amount available and usually paid in one lump sum. Generally benefits received are income tax-free. Consult your tax professional to assess the impact of this benefit.

ICC18 8731 4-18, 8731 4-18 (XX). All contractual provisions apply and may vary by state. Benefit payments may affect eligibility for public assistance programs. Certain eligibility requirements apply. This rider is not long term care insurance, nor is it intended to replace long term care insurance. Maximum benefit for terminal illness is the lesser of $250,000 or 65% of death benefit amount available and usually paid in one lump sum. Maximum benefit for chronic illness is the lesser of $250,000 or 50% of the death benefit amount available, subject to the annual per diem limitation declared by the Internal Revenue Service. Payments made under this rider are intended to qualify for favorable tax treatment under the Internal Revenue Code. As with all tax matters, a tax professional should be consulted to assess the impact of this benefit. Not available in CA or NY.

Universal Life insurance products contain fees, such as mortality and expense charges (which may increase over time), and may contain restrictions, such as surrender periods. This certificate could lose money. WoodmenLife will provide notification if the guaranteed monthly deductions and interests are expected to exhaust the plan’s cash values prior to the maturity date. This certificate is not guaranteed to stay in force until maturity based on minimum guarantees.

All products may not be available in all states.

Flexible Premiums Adjustable Indexed Life Certificates ICC18 8730 4-18, 8730 4-18 (XX).

The “S&P 500®” is a product of S&P Dow Jones Indices LLC, a division of S&P Global, or its affiliates (“SPDJI”), and has been licensed for use by Woodmen of the World Life Insurance Society (“WoodmenLife”). Standard & Poor’s® and S&P® are registered trademarks of Standard & Poor’s Financial Services LLC, a division of S&P Global (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”). It is not possible to invest directly in an index. WoodmenLife’s flexible premium adjustable indexed life insurance certificate (the “Certificate”) is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, or any of their respective affiliates (collectively, “S&P Dow Jones Indices”). S&P Dow Jones Indices does not make any representation or warranty, express or implied, to the owners of the Certificate or any member of the public regarding the advisability of investing in securities generally or in this certificate particularly or the ability of the S&P 500® to track general market performance. Past performance of an index is not an indication or guarantee of future results. S&P Dow Jones Indices’ only relationship to WoodmenLife with respect to the S&P 500® is the licensing of the Index and certain trademarks, service marks and/or trade names of S&P Dow Jones Indices and/or its licensors. The S&P 500® is determined, composed, and calculated by S&P Dow Jones Indices without regard to WoodmenLife or the Certificate. S&P Dow Jones Indices has no obligation to take the needs of WoodmenLife or the owners of the Certificate into consideration in determining, composing, or calculating the S&P 500®. S&P Dow Jones Indices is not responsible for and has not participated in the determination of the prices, and amount of the Certificate or the timing of the issuance or sale of the Certificate or in the determination or calculation of the equation by which the Certificate is to be converted into cash, surrendered or redeemed, as the case may be. S&P Dow Jones Indices has no obligation or liability in connection with the administration, marketing or trading of the Certificate. There is no assurance that the Certificate based on the S&P 500® will accurately track index performance or provide positive returns. S&P Dow Jones Indices LLC is not an investment or tax advisor. A tax advisor should be consulted to evaluate the impact of any tax-exempt securities on portfolios products and the tax consequences of making any particular purchase decision. Inclusion of a security within an index is not a recommendation by S&P Dow Jones Indices to buy, sell, or hold such security, nor is it considered to be investment advice.

S&P DOW JONES INDICES DOES NOT GUARANTEE THE ADEQUACY, ACCURACY, TIMELINESS, AND/OR THE COMPLETENESS OF THE S&P 500® OR ANY DATA RELATED THERETO OR ANY COMMUNICATION, INCLUDING BUT NOT LIMITED TO, ORAL OR WRITTEN COMMUNICATION (INCLUDING ELECTRONIC COMMUNICATIONS) WITH RESPECT THERETO. S&P DOW JONES INDICES SHALL NOT BE SUBJECT TO ANY DAMAGES OR LIABILITY FOR ANY ERRORS, OMISSIONS, OR DELAYS THEREIN. S&P DOW JONES INDICES MAKES NO EXPRESS OR IMPLIED WARRANTIES, AND EXPRESSLY DISCLAIMS ALL WARRANTIES, OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE OR AS TO RESULTS TO BE OBTAINED BY WOODMENLIFE, OWNERS OF THE CERTIFICATE, OR ANY OTHER PERSON OR ENTITY FROM THE USE OF THE S&P 500® OR WITH RESPECT TO ANY DATA RELATED THERETO. WITHOUT LIMITING ANY OF THE FOREGOING, IN NO EVENT WHATSOEVER SHALL S&P DOW JONES INDICES BE LIABLE FOR ANY INDIRECT, SPECIAL, INCIDENTAL, PUNITIVE, OR CONSEQUENTIAL DAMAGES INCLUDING BUT NOT LIMITED TO, LOSS OF PROFITS, TRADING LOSSES, LOST TIME OR GOODWILL, EVEN IF THEY HAVE BEEN ADVISED OF THE POSSIBILITY OF SUCH DAMAGES, WHETHER IN CONTRACT, TORT, STRICT LIABILITY, OR OTHERWISE. THERE ARE NO THIRD PARTY BENEFICIARIES OF ANY AGREEMENTS OR ARRANGEMENTS BETWEEN S&P DOW JONES INDICES AND WOODMENLIFE, OTHER THAN THE LICENSORS OF S&P DOW JONES INDICES.

Web 127 R-8/25