HEALTH INSURANCE HSA

Customer Service: 1-800-284-4885

Customer Service: 1-800-284-4885

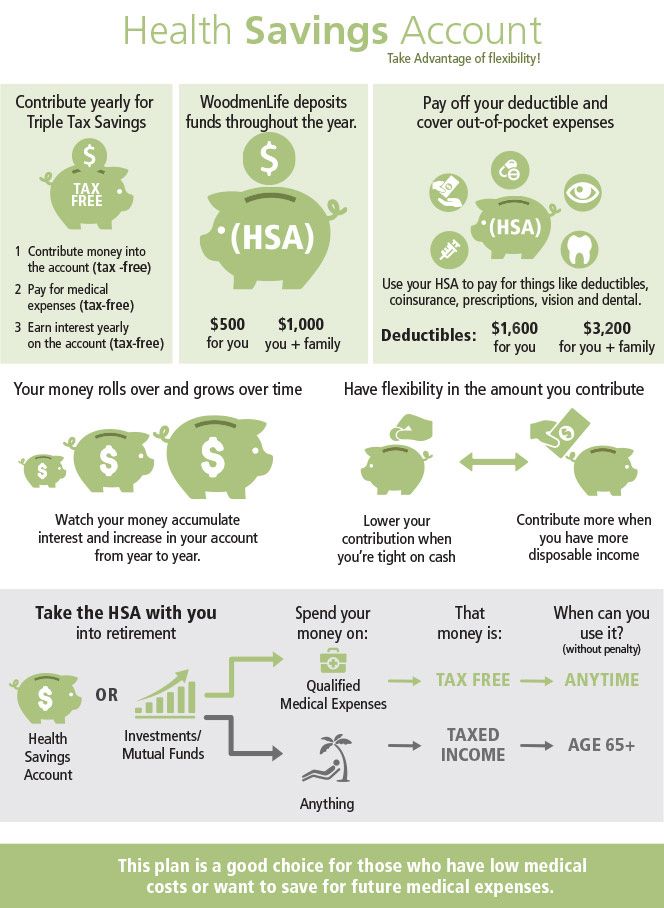

You will receive a PayFlex Card to pay for eligible expenses, but there are also other ways to use your HSA funds. If you pay out of pocket, you can request reimbursement from your HSA. You can also have the reimbursement deposited into your personal checking or savings account, or pay the provider directly with the electronic bill payment tool.

Some of the many ways you can use your HSA funds include:

Deductibles and coinsurance;

Prescription drugs;

Glasses, LASIK eye surgery and contact lenses;

Dental and orthodontic care;

Chiropractic and acupuncture treatments;

Certain fertility services, including IVF; and

Medicare premiums during retirement.

Form 1099-SA

This form shows withdrawals from your HSA. The information needs to be included on the federal tax return. This form will be mailed at the end of January; you can also download it from the PayFlex member website.

Form 5498-SA

This form reports your contributions to your HSA, and should be retained for your records. This form is not needed to file your federal tax return. PayFlex will mail you the form in May or you can access it on the PayFlex member website.

Available to those enrolled in the Select HSA Plan (Health)

You are eligible to contribute to the HSA if you:

Are not covered by any other health plan, unless it is another HSA compatible health plan;

Are not enrolled in Medicare, if Medicare eligible;

May not be claimed as a dependent on another person’s tax return.

PayFlex App StorePlay | PayFlex Google Play

After the health claim has been processed by Blue Cross and Blue Shield, your portion can be paid with the Health Savings Account (HSA).

WoodmenLife provides up to $500 per year into the savings account for associate only coverage and $1,000 for associate plus coverage. The employer contribution will be made in equal installments based on the number of eligible pay periods.

The amount will be prorated if you are not enrolled for the entire year. You also have the opportunity to contribute funds to this account on a pre-tax basis. The combined employer and associate contribution is limited to:

2026: $4,400 for Associate Only and $8,750 for Associate Plus coverages

2025: $4,300 for Associate Only and $8,550 for Associate Plus coverages

Those age 55 or older can contribute an additional $1,000 in catch-up contributions.

Log in to Dayforce and go to the Benefits page. Click on the Health Savings Account Periodic Changes Enrollment event. The amount you elect will be divided by the amount of pay periods remaining in the year. You will be asked to verify the amount that will come out of your check prior to it being approved.

If you are enrolled in the WoodmenLife group medical plan, WoodmenLife will pay the cost of the monthly maintenance fee.